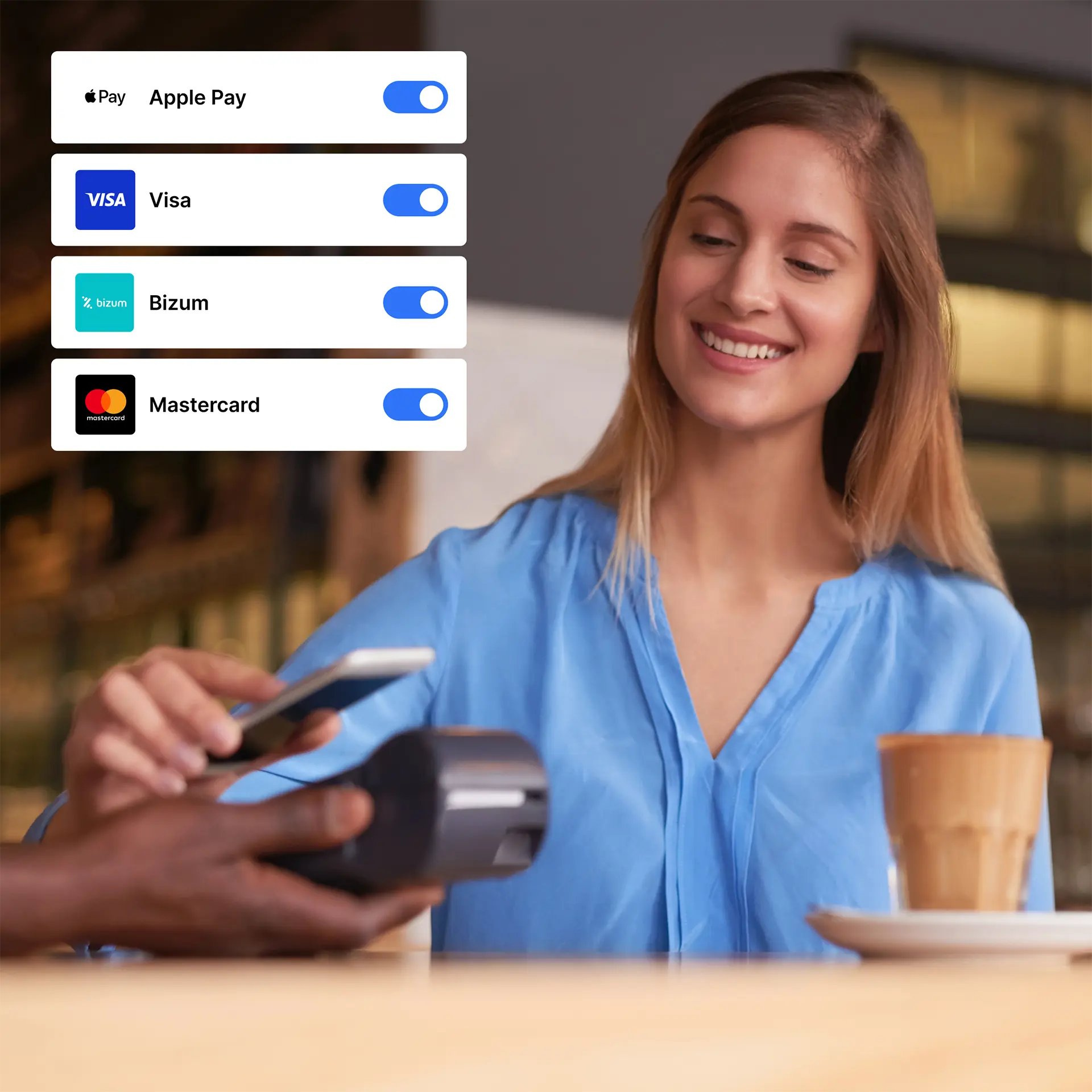

Accept the payment methods your customers already use

Cards, Bizum, Apple Pay, Google Pay, PayPal, and more. Accept online, in-person, or mobile payments from a single platform.

More than 1,000 customers already trust Sipay

Businesses of all sizes rely on Sipay to connect their business with customers globally.

Payment methods with global reach and local expertise

Offer your customers their preferred payment method according to their market: cards, Bizum, wallets and transfers, all from a single integration.

Credit and debit cards

Grow your business by accepting credit and debit cards from around the world, with a fast and secure payment experience for your customers.

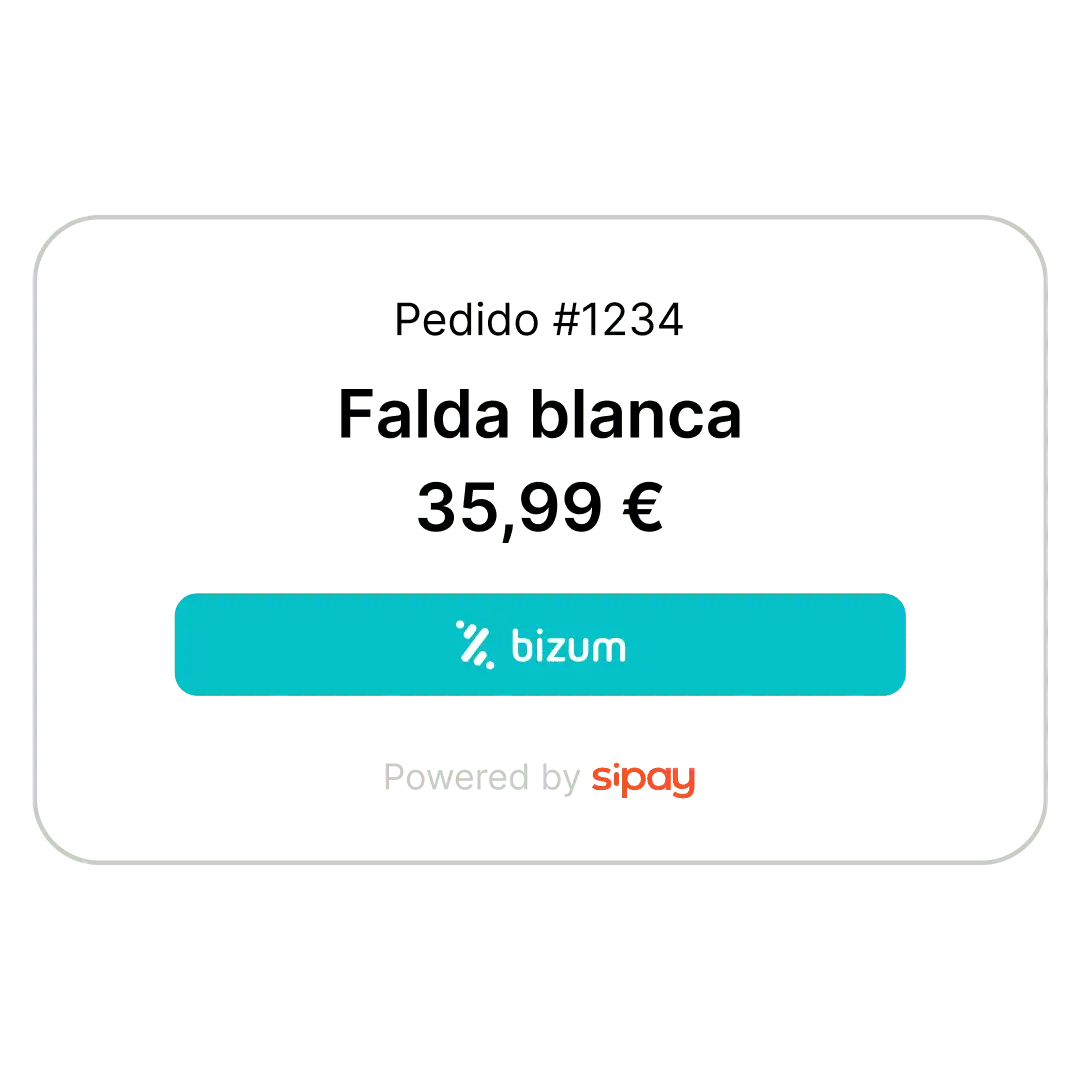

Payments via Bizum

Accept Bizum payments on your website, app, or physical store. Connect with millions of users and offer the most used alternative payment method in Spain.

Apple Pay and Google Pay

With Sipay, you can accept payments with Apple Pay and Google Pay across all your channels. Offer your customers a fast, secure, and contactless experience.

Custom checkout

Set up your custom payment wall with the payment methods your customers prefer and improve your conversion data.

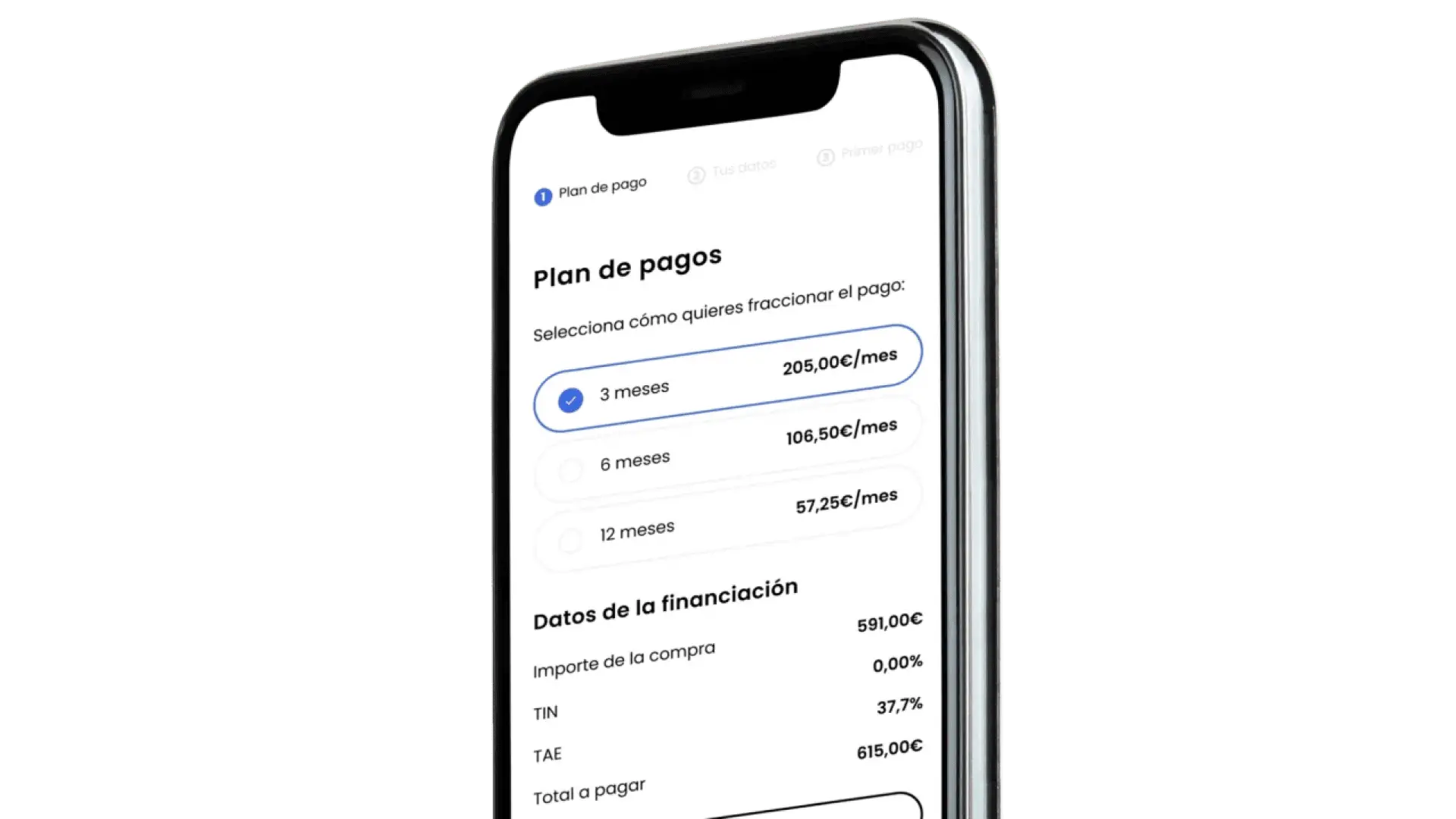

BNPL & Lending

Improve conversion and average ticket size with flexible financing for your customers with BNPL & Lending solutions across all your sales channels.

International methods

Expand your reach to all global markets by accepting international payment methods such as MB Way, Alipay+, Pix, and other local options.

A solution for businesses

of any size

A solution for businesses of any size

Whether you are starting your business or scaling it up, we offer you the tools you need to achieve success.

Access multiple payment

methods with a single click

Access multiple payment methods

with a single click

Customers pay differently in each market. With Sipay, your business can offer the payment methods your customers prefer in a seamless, secure experience tailored to each market.

New markets

Reach new markets and connect with customers around the world without complications.

Seamless experience

It offers an experience tailored to each market to make it easier for your customers to pay.

Higher conversion

Increase your sales by reaching more users and offering their preferred payment method.

Unique integration

A single integration to manage all your payment methods and channels.

It integrates seamlessly with your existing tools.

Optimize your payment collection operations with Sipay through a single secure, flexible, and scalable connection.

More ways to pay, greater reach

Offer the payment methods your customers prefer locally and globally, and connect with more markets to grow your revenue.

Transparent and flexible pricing that adapts to you

Start selling now on all your channels, pay only for what you use, and scale your business with the full potential of Sipay.

Basic

Everything you need in a clear and transparent model, with no permanence and no surprises.

15 € / month

Price per terminal*.

Up to 1,000 transactions per month.

Includes:

- Enjoy all the features

- Quick and easy setup

- Cancel anytime

- Pay for what you use

Enterprise

Need a customized solution for your business? Get personalized pricing tailored to your needs.

Tailored

Includes:

- Dedicated expert for your account

- IC++ Model

- Cost savings

- Exclusive benefits

- Global acquiring

- Prices adapted to each country

Questions? We have answers

We answer your questions about local and global payment methods.

What payment methods can I accept with Sipay?

With Sipay, you can accept credit and debit cards, Bizum, Apple Pay, Google Pay, PayPal, bank transfers, local and international methods such as Alipay+ or PIX, and more.

Do I need separate integrations for each payment method?

No. With a single integration, you can enable all available payment methods and manage them from a single dashboard.

Can I offer different methods depending on the country or channel?

Yes. You can activate the most popular payment methods by region, customer type, or sales channel (online, app, or physical store).

Does Sipay comply with security regulations?

Yes. All transactions are protected with advanced encryption and PCI DSS 4.0 certification, ensuring maximum security for you and your customers.

How does offering more payment methods help my business?

Increase conversion, reduce checkout abandonment, and improve the customer experience by offering them their preferred payment option.

Can I include Bizum in my physical store or POS system?

Yes. Sipay allows you to accept Bizum both online and in person, with direct integration into your POS terminal or payment gateway.

Which digital wallets are compatible with Sipay?

Sipay integrates Apple Pay, Google Pay, and other international wallets, offering a fast, secure, and contactless payment experience.

Are international payment methods available to all merchants?

Yes. You can enable global methods such as Alipay+ or PIX and combine them with local options, depending on the market in which you operate.

Simplify payments and optimize your business management

Boost your sales and manage your business easily.