Orchestrated financing to increase your sales

Automate your payments, improve retention, and manage your recurring revenue with Sipay’s smart payment technology.

More than 1,000 customers already trust Sipay

Businesses of all sizes rely on Sipay to connect their business with customers globally.

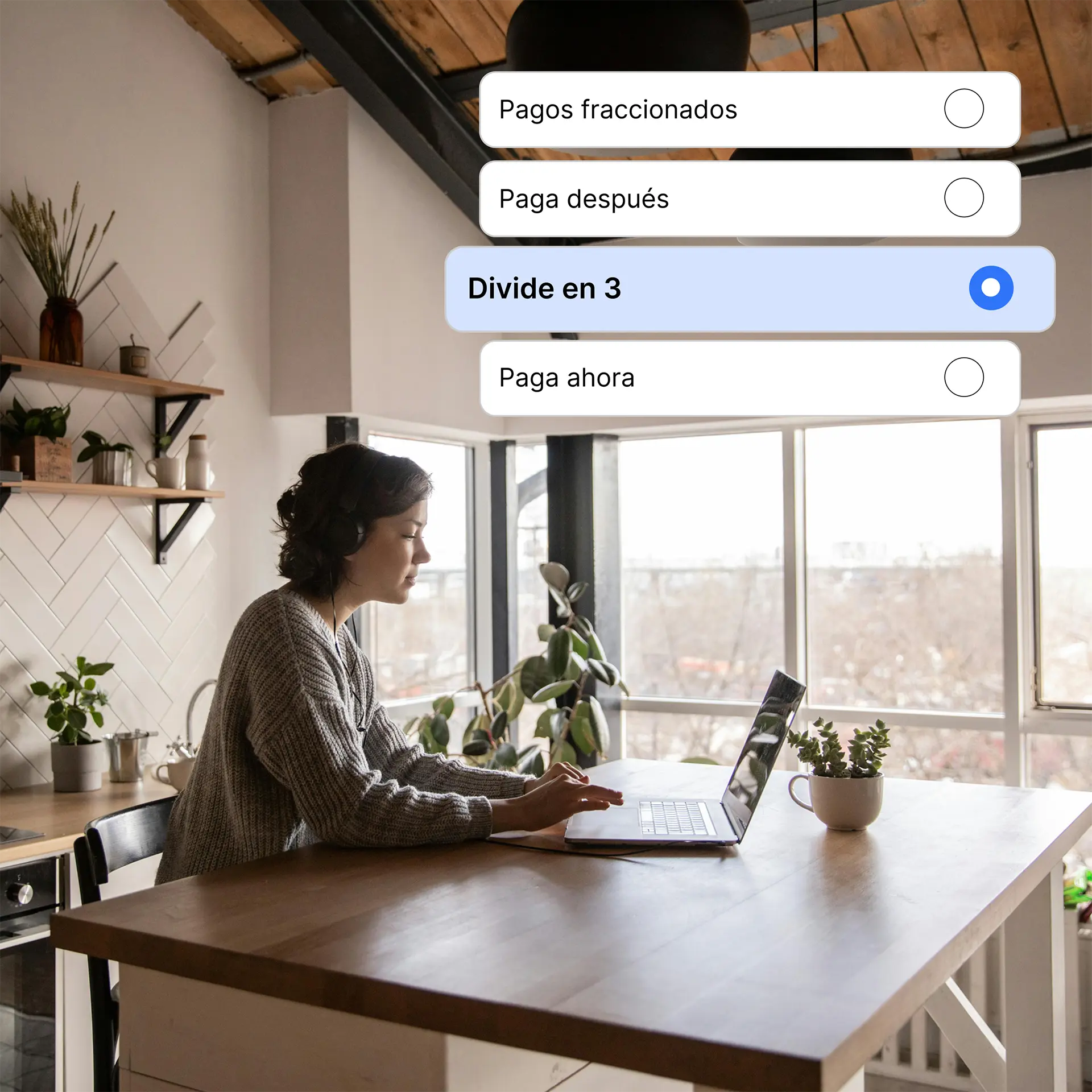

Offer BNPL & Lending to your customers and boost your revenue

Increase conversion and improve your customers’ shopping experience with flexible financing solutions tailored to each sector.

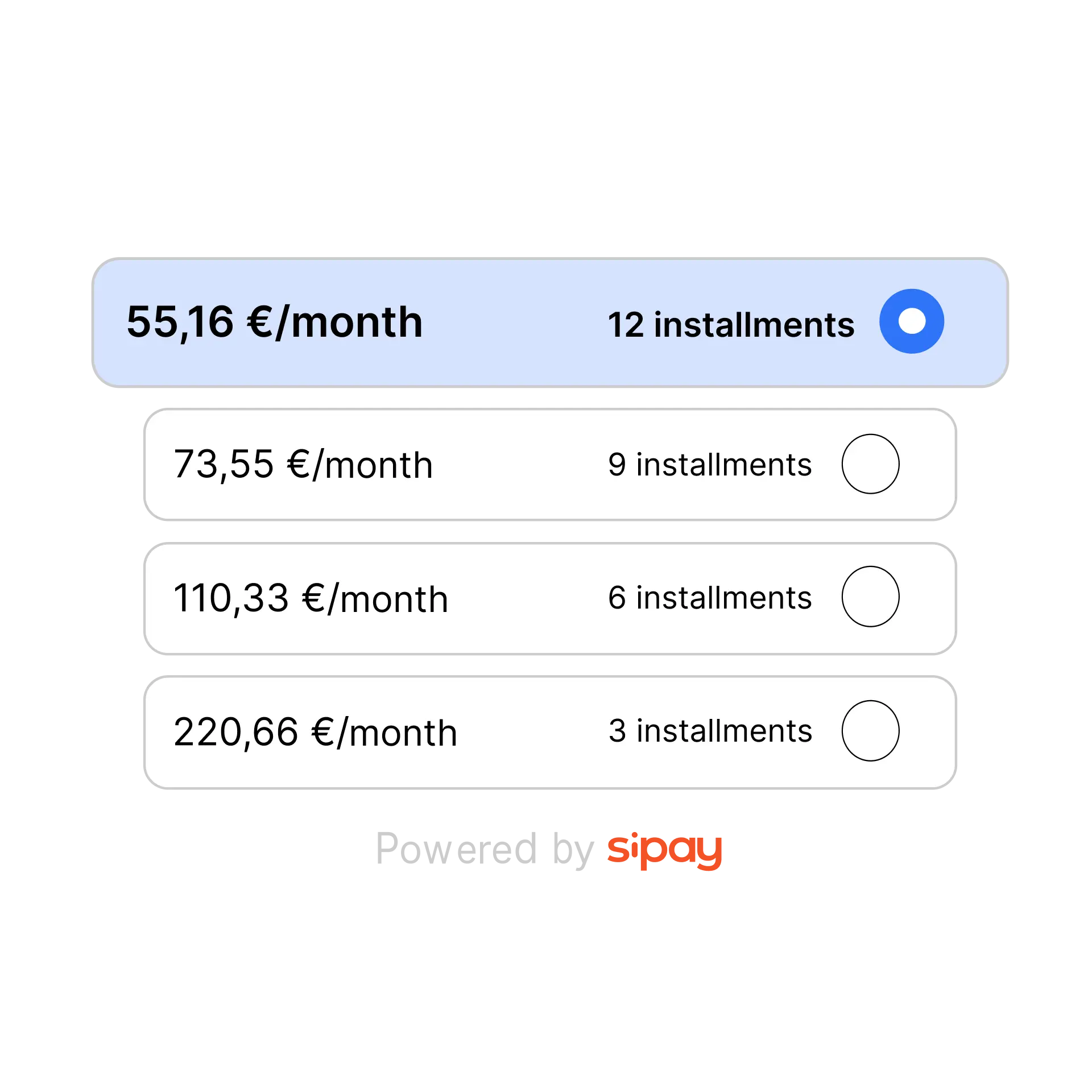

Payment in installments

Allows the customer to divide the purchase amount into fixed monthly installments to facilitate the sale.

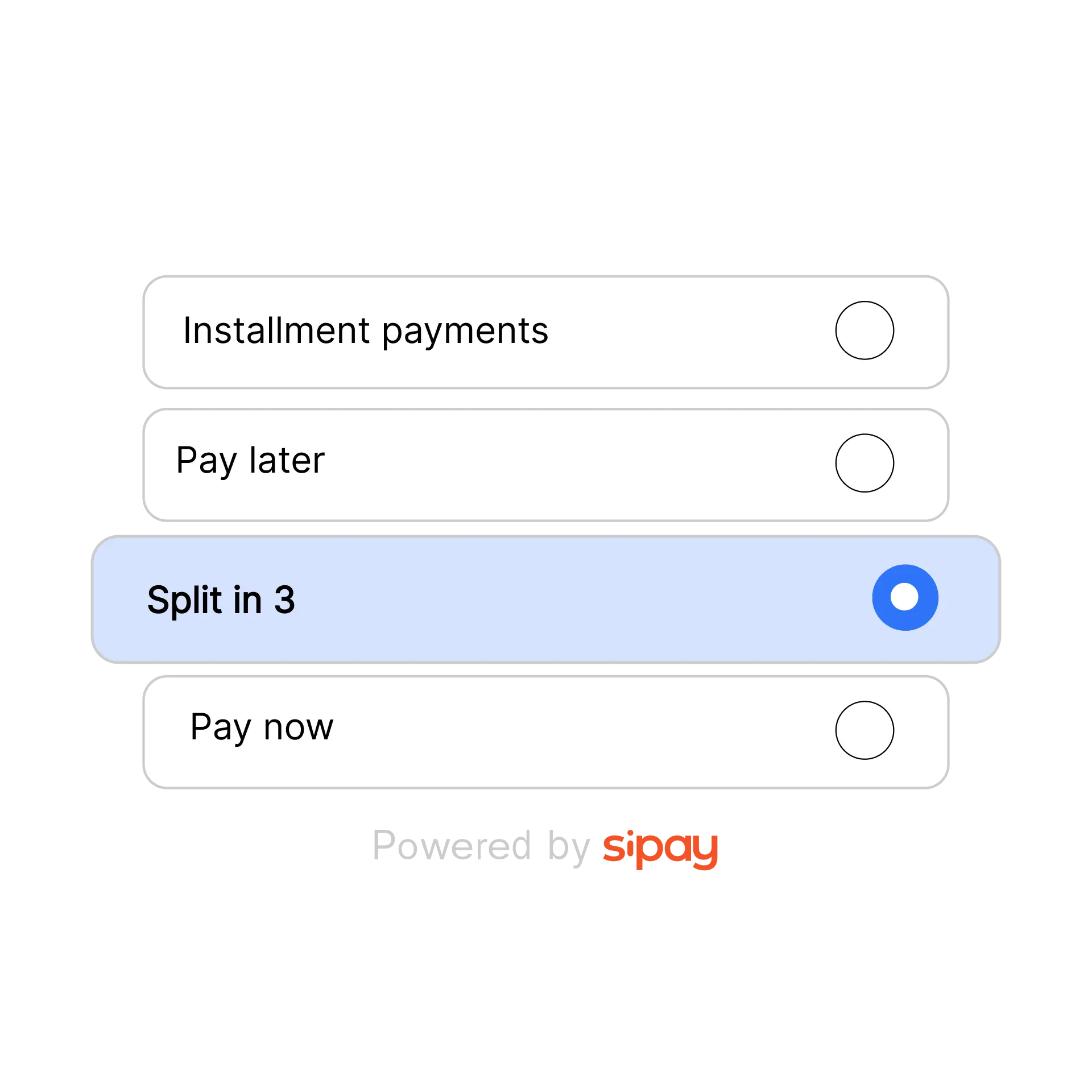

Split payments

Option to split the purchase into several flexible installments with no interest, as part of the checkout process.

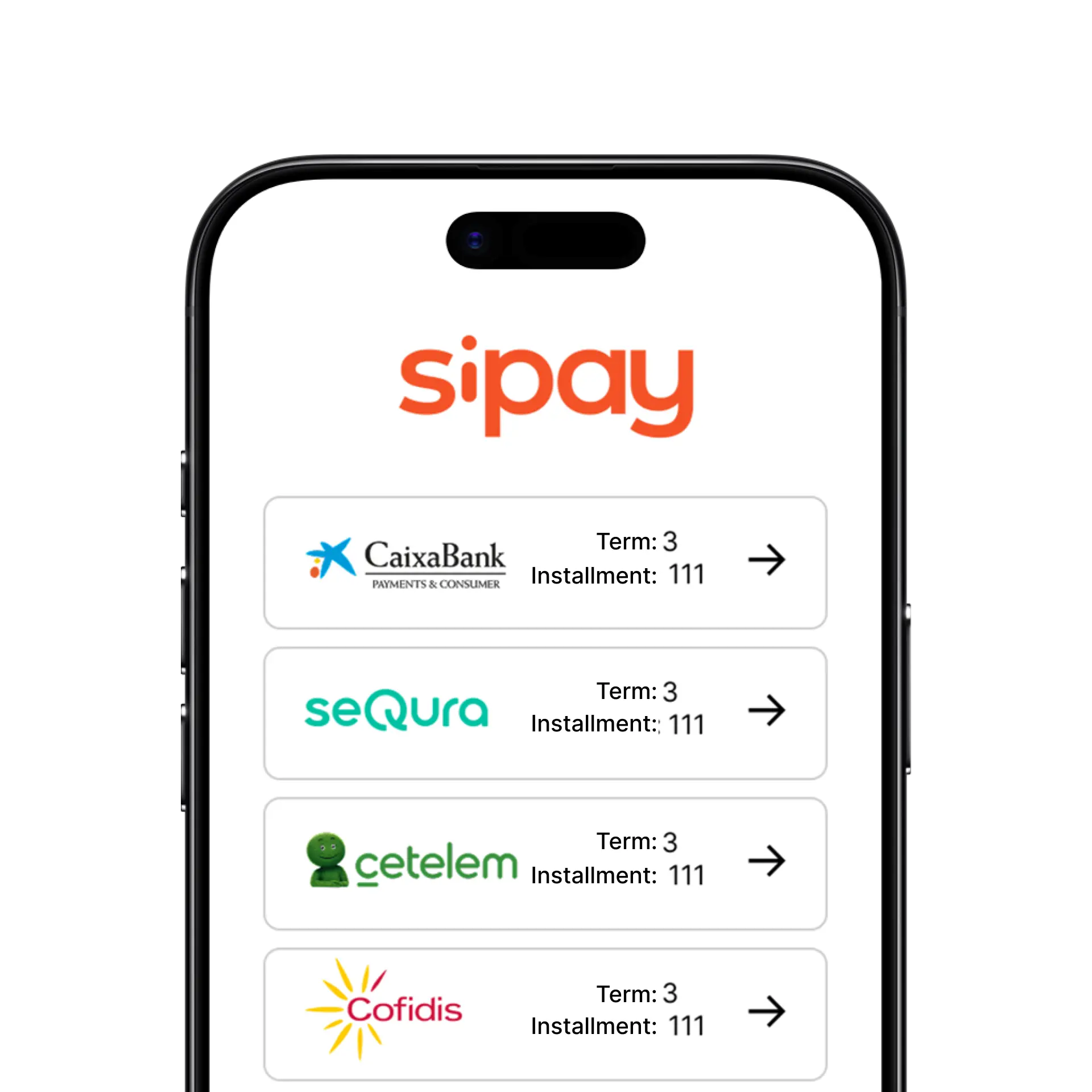

Orchestrated financing

Connects with multiple credit institutions so that customers can obtain the best possible option in real time.

Smart financing, tangible results

Customers buy more when they have flexible payment options. With a single integration, you can access payment methods and BNPL & Lending.

A flexible payment solution that adapts to your customers

From retail to digital platforms, Sipay’s orchestrated financing adapts to multiple sectors to offer a more accessible and profitable shopping experience.

Retail

Increase the average ticket size by offering financing at physical and online points of sale.

Marketplaces

Facilitate split payments directly at checkout, without redirecting the customer.

Technology and electronics

Offer financing to your customers so you don’t lose a sale and increase the average ticket size.

Education and training

Help your customers access courses or memberships through flexible payment plans.

Mobility and transport

Allows you to pay in installments for leasing, maintenance, or shared mobility services.

Hospitality and tourism

Facilitates reservations and experiences with deferred payment without financial risk for the hotel or agency.

Connect with value-added solutions for your business

Access the most comprehensive ecosystem in the fintech sector and connect with the driving force behind innovation in payments.

A solution for businesses

of any size

Whether you are starting your business or scaling it up, we offer you the tools you need to achieve success.

Transparent and flexible pricing that adapts to you

Start selling now on all your channels, pay only for what you use, and scale your business with the full potential of Sipay.

Basic

Everything you need in a clear and transparent model, with no permanence and no surprises.

15 € / month

Price per terminal*.

Up to 1,000 transactions per month.

Includes:

- Enjoy all the features

- Quick and easy setup

- Cancel anytime

- Pay for what you use

Enterprise

Need a customized solution for your business? Get personalized pricing tailored to your needs.

Tailored

Includes:

- Dedicated expert for your account

- IC++ Model

- Cost savings

- Exclusive benefits

- Global acquiring

- Prices adapted to each country

Questions? We have answers

Here are answers to frequently asked questions about BNPL & Lending.

What does orchestrated financing mean?

It is a model that combines different financing options into a single integration, offering the best alternative for each customer without risk to the business.

How long does it take for the business to receive the money?

The merchant receives the total amount of the sale immediately, while the customer pays for their purchase in the selected installments.

Can I offer BNPL both online and in a physical store?

Yes, Sipay’s BNPL & Lending solution is available in both digital and in-person environments, fully integrated with your system.

How is the risk of non-payment managed?

The risk is assumed by the collaborating financial institutions. The merchant always receives full payment without having to worry about credit management.

Can I integrate this solution with other Sipay products?

Yes, BNPL & Lending integrates seamlessly with the payment gateway, Sipay POS, and Pay by Link to provide a unified and smooth experience.

Simplify payments and optimize your business management

Boost your sales and manage your business easily.