Global acquiring with direct connection to card networks

Process payments quickly and securely, with a license from the Bank of Spain and a direct connection to Visa and Mastercard. A certified solution that can be adapted to any business model.

Boost your income, improve your margins, and manage your collections through direct acquiring with Uinku, a Sipay Group company. A global, secure, and certified connection that offers better conditions than traditional banks and new single acquirers.

Smart acquiring that powers your payments

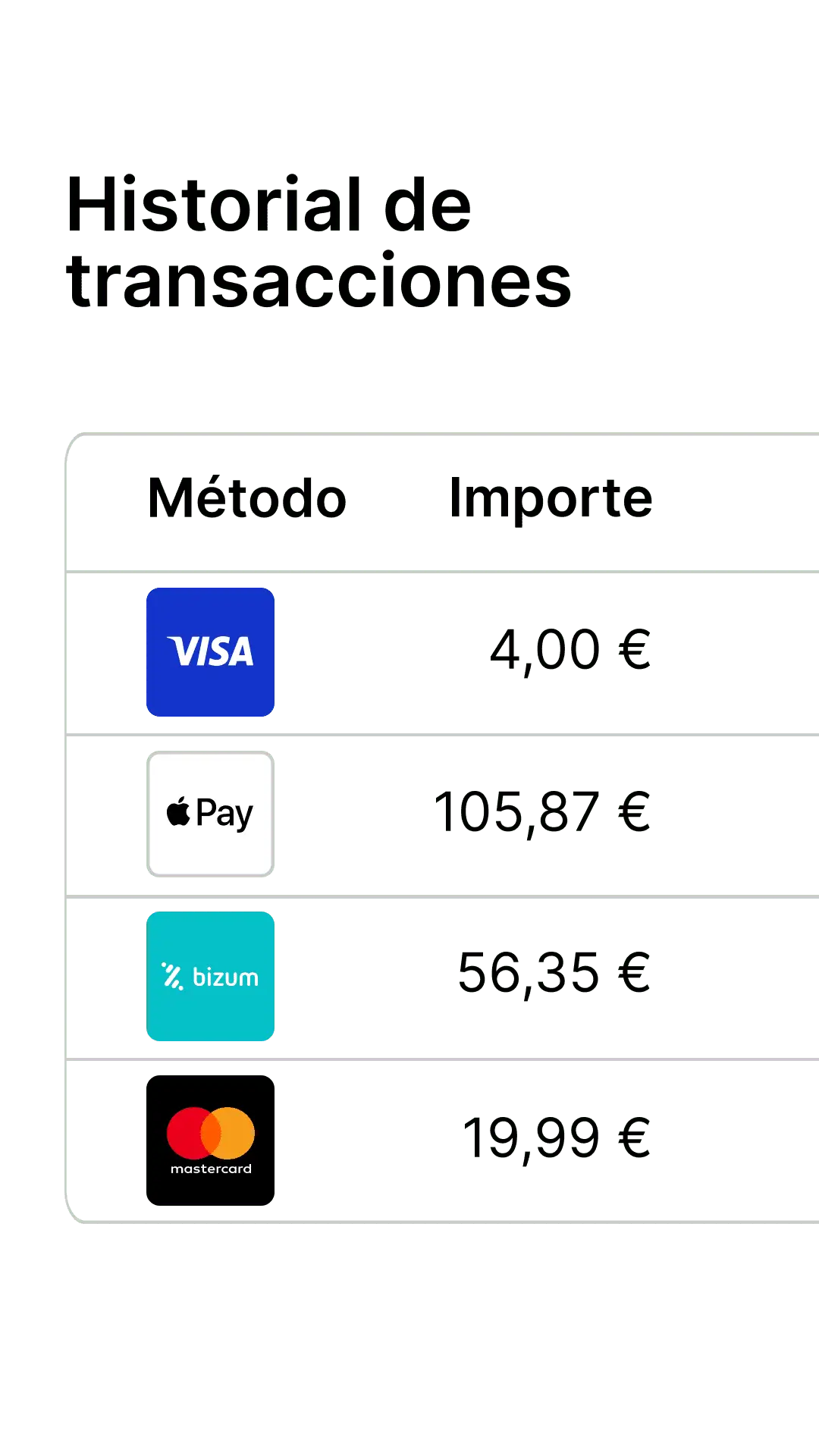

Payment methods

A single integration for cards, Bizum, PayPal, Apple Pay, and more. Maximize conversion by offering the payment options your customers prefer.

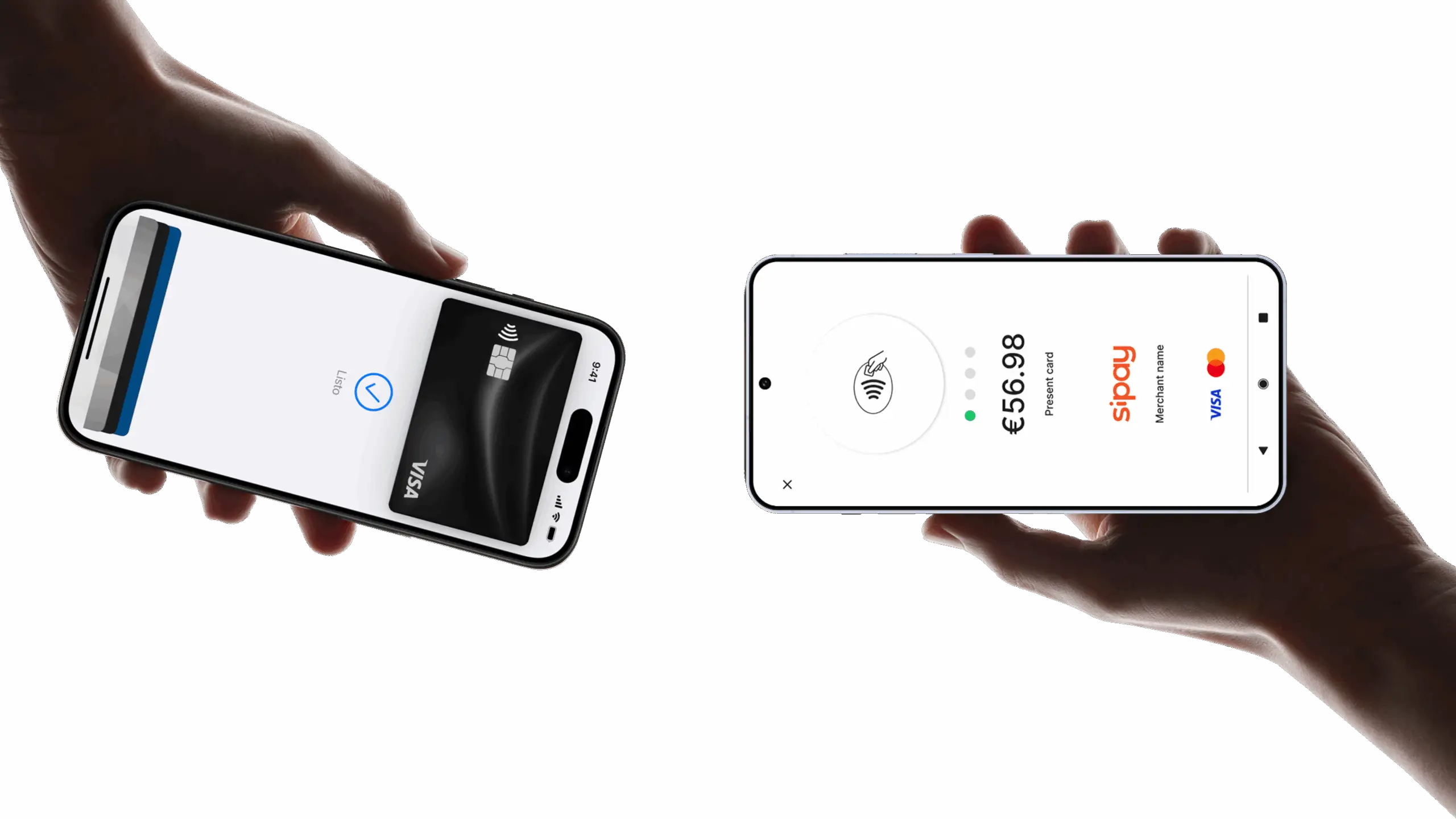

In-person payments

Offer frictionless payments. Accept any payment method with solutions tailored to your business: from mobile or fixed terminals to Tap to Pay.

Online payments

Accept online payments quickly and securely. Integrate our gateway into your eCommerce site or app and offer your customers all their preferred payment methods.

Tap to Pay on Android

Accept contactless payments directly with your mobile phone. Turn your mobile phone into a payment terminal, without additional card readers or extra hardware.

Greater security, more income

Protect every transaction with a PCI DSS-certified payment platform designed to prevent fraud and control risk.

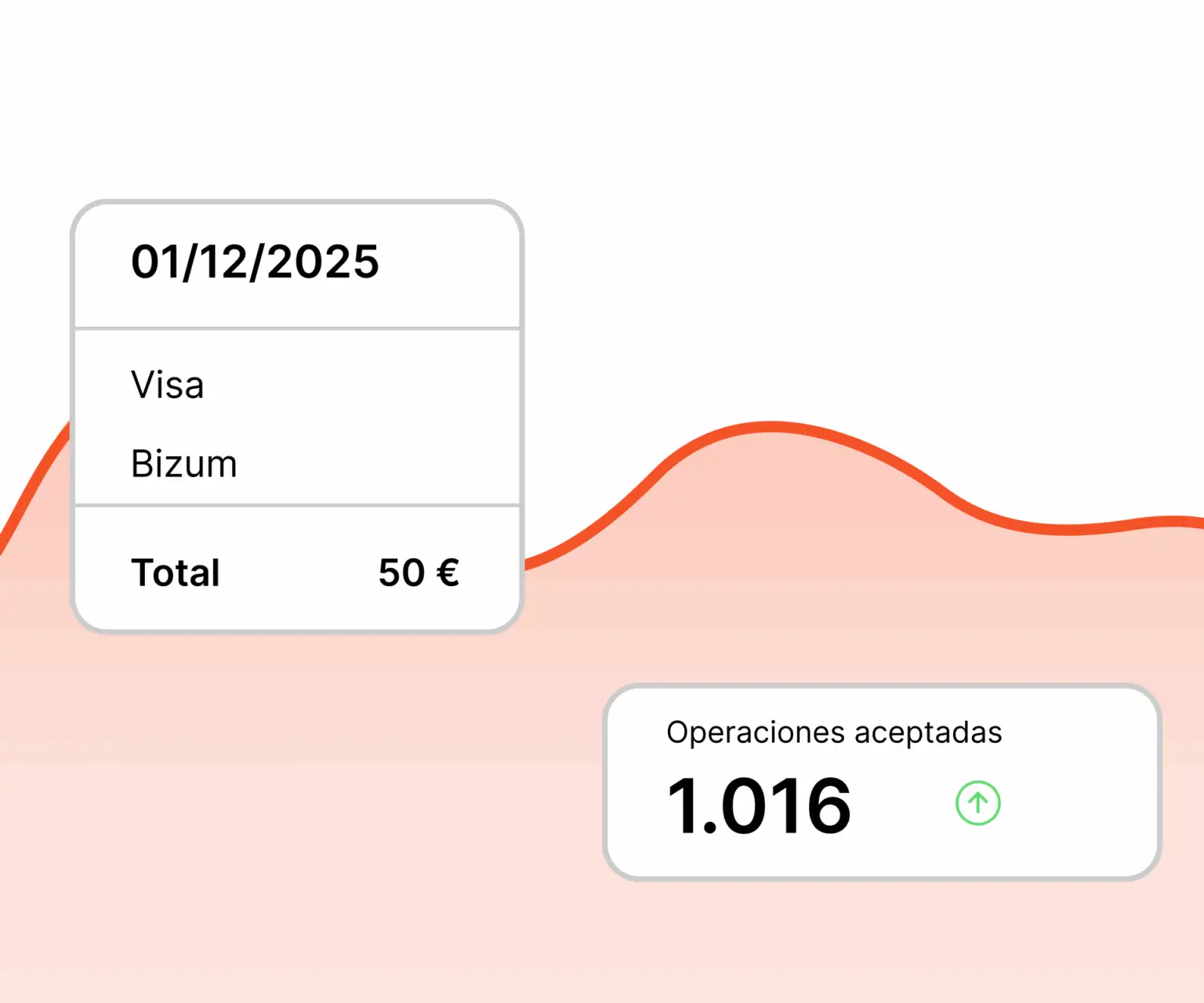

Total control with real-time data

View all your operations on a single dashboard. Monitor sales, collections, and performance in real time to make data-driven decisions.

Acquiring in figures

Acquiring

in figures

Solidity and trust: Uinku is a payment institution regulated by the Bank of Spain, belonging to the Sipay Group.

Make the leap to direct acquiring

Activate Uinku’s direct acquiring service and start processing payments more cost-effectively, quickly, and without intermediaries.

A solution for businesses

of any size

Whether you are starting your business or scaling it up, we offer you the tools you need to achieve success.

Digital

Increase conversion rates and offer secure payments on your online channel.

Transparent and flexible pricing that adapts to you

Start selling now on all your channels, pay only for what you use, and scale your business with the full potential of Sipay.

Basic

Everything you need in a clear and transparent model, with no permanence and no surprises.

15 € / month

Price per terminal*.

Up to 1,000 transactions per month.

Includes:

- Enjoy all the features

- Quick and easy setup

- Cancel anytime

- Pay for what you use

Enterprise

Need a customized solution for your business? Get personalized pricing tailored to your needs.

Tailored

Includes:

- Dedicated expert for your account

- IC++ Model

- Cost savings

- Exclusive benefits

- Global acquiring

- Prices adapted to each country

Questions? We have answers

We answer your questions about payment processing and acquiring solutions.

What is acquiring and why is it important for my business?

Acquiring is the service that allows you to process card payments and other digital methods. With Uinku, you can do so directly, securely, and without intermediaries, improving your margins and settlement times.

What advantages does direct acquiring have over acquiring by banks and single-acquirers?

It offers lower fees, global connection with Visa and Mastercard, and greater control over your payments. In addition, Uinku allows you to optimize conversion with smart balancing between acquirers. It is a more flexible and transparent model that adapts to each business.

Can I use Uinku if I already have a payment gateway?

Yes. Our infrastructure integrates easily with existing gateways, eCommerce platforms, or POS systems, without the need to replace your current solution.

How does Uinku guarantee the security of transactions?

Uinku operates under the highest industry standards: PCI DSS 4.0 certification, PSD2 compliance, and a license from the Bank of Spain. In addition, we use tokenization and real-time fraud detection.

Can I work with multiple acquirers at the same time?

Yes. Uinku allows multi-acquirer, giving you the freedom to operate with multiple banks and optimize each transaction according to country, currency, or card type.

Simplify payments and optimize your business management

Boost your sales and manage your business easily.